You can invest in oeics tax free through an investment isa so your profits will be free from capital gains and income tax. If investment company shares are held within a tax wrapper such as an isa, there is no tax on income or capital gains.

What Is A Discretionary Trust Advantages And Disadvantages - Infographic Httpwwwassetprotectionpackag Budgeting Money Budgeting Finances Financial Tips

60)) which are incorporated in the united kingdom.

Open ended investment company taxation. The main risk is that the value of the oeic could decrease. Any part of the gain which falls within the basic rate tax band is taxed at 10% and the balance will be taxed at 20%. Lps can be used for tax efficiency purposes to avoid double taxation (corporate taxation at the underlying company level and at the fund level).

The direct tax treatment of oeics is established by the authorised investment. Open ended investment company (oeic): If the special regime applies, investment vehicles are taxed at 1% corporate income tax rate.

During the 2019/20 tax year you can invest up to £20,000 in a stocks and shares isa. Calculating the gain cgt on unit trusts and oeics is calculated using an average cost basis. The key differences between the taxation of investment companies and other funds, such as oeics and unit trusts, relate to two areas:.

The company pools money it raises by selling shares in a fund and the fund's manager invests in stock, bonds, money market instruments, or a combination of these asset classes to. If the special regime applies, investment vehicles are taxed at 1% corporate income tax rate. The regulations secure that the tax acts and the 1992 act have effect in relation to.

These regulations make provision for the tax treatment under the tax acts and the taxation of chargeable gains act 1992 (c. Instead, investors pay tax when they receive income or realise a capital gain on their investment. These regulations make provision for the tax treatment under the tax acts and the taxation of chargeable gains act 1992 (c.

These regulations make provision for the tax treatment under the tax acts and the taxation of chargeable gains act 1992 (c. 60)) which are incorporated in the united kingdom. The regulations secure that the tax acts and the 1992 act have effect in relation to.

60)) which are incorporated in the united kingdom. An oeic generates income for the investor, albeit that with accumulation shares, income is not distributed but instead reinvested and added to capital. The oeic's shares are listed on the london stock exchange and the price of the shares are based largely on the underlying assets of the fund.

Little or no tax is paid by the fund;

Difference Between Epf And Ppf Income Investing Investing Basic

Business Startup Solutions Business Ideas For Beginners Start Up Business Start Up

Pour Your Taxes Into Your Investments Investing Portfolio Strategy Risk Management

Invest In Mirae Asset Cash Management Fund To Get Stable Returns Mirae Asset Cash Management Mutual Funds Investing Investing

Cost Of Goods Sold Cogs All You Need To Know In 2021 Accounting Financial Management Website Development Process

Is Building As Usual Still A Sustainable Responsible Option Climate Adaptation Climate Change Infographic Infographic

Best Financial Advisor Provider In Delhi Ncr Regular Investment Plans Systematic Investment Plan Wealth Management Services Investing

Invest In Mirae Asset Cash Management Fund To Get Stable Returns Mirae Asset Cash Management Mutual Funds Investing Investing

Download Free Illustrations Of Vat Value Added Tax Document Magnifying Data Glass Calculate Audit Han Value Added Tax Indirect Tax Accounting Services

Capital Gains Tax How To Avoid Paying Tax On Property Capital Gains Tax Capital Gain Paying Taxes

Tax Flowchart Do You Have To File A Return Flow Chart Flow Chart Template Process Flow Chart Template

With Stock Markets Going Highly Volatile Equity Market Movements Are Not Making Sense Debt Funds Are Facing Defau Safe Investments Investing Best Investments

Bancassurance To Catch On In Vietnams Life Insurance Market Life Insurance Companies Insurance Industry Fund Management

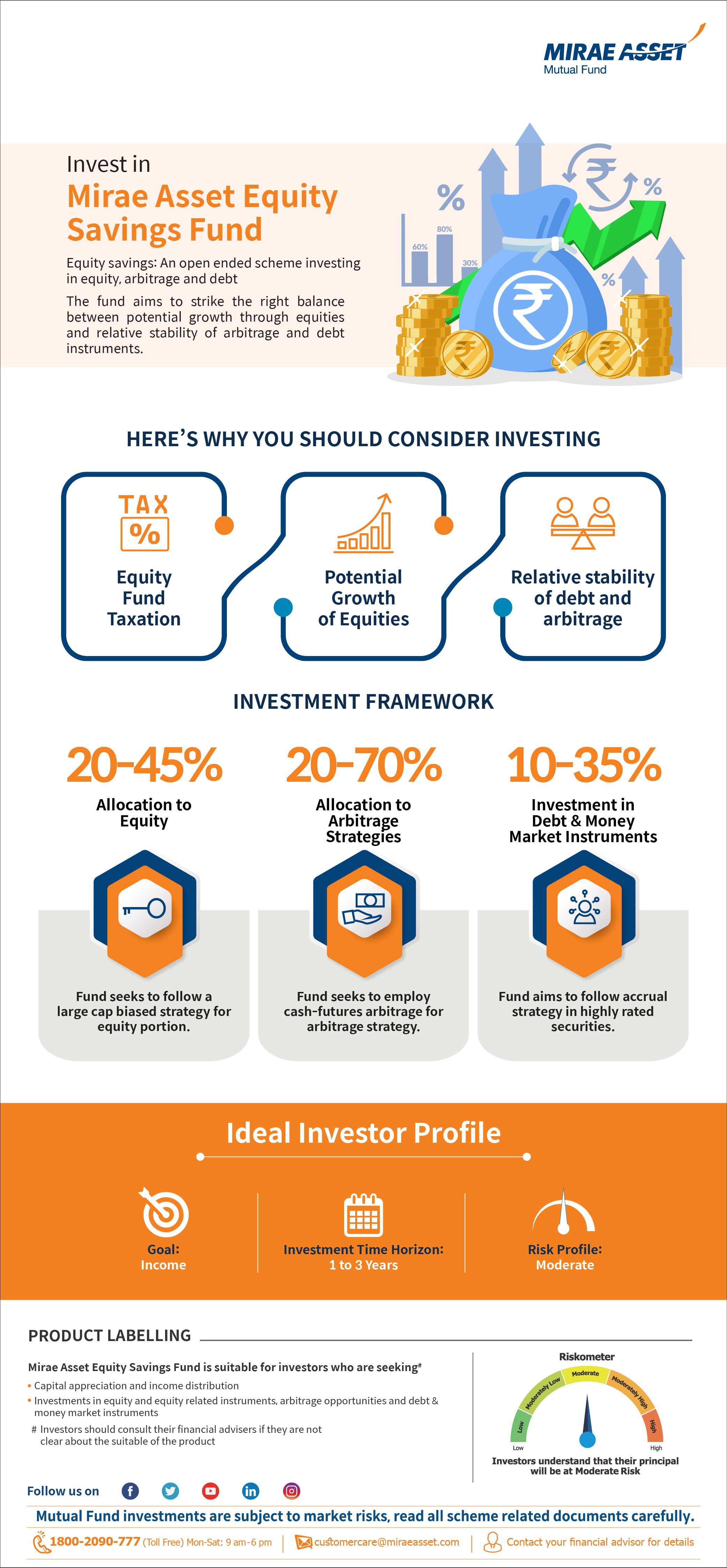

Invest In Mirae Asset Focused Fund For Wealth Creation Mirae Asset Mutual Funds Investing Equity Investing

Kotak Global Innovation Fund Of Fund 2021 In 2021 Investing Global Fund Innovation

Section 80c 80cc - Deductions Income Tax Deductions Under Chapter Vi For Ay 2021-22 Tax Deductions Income Tax Income Tax Return

Advantages And Disadvantages Of Mutual Funds 2021 Guide Mutuals Funds Financial Management Fund

Pin On Taxation

Types Of Mutual Funds Investing Mutuals Funds Safe Investments

Open Ended Investment Company Taxation. There are any Open Ended Investment Company Taxation in here.